www.aspirecreditcard.com acceptance code – The Aspire Account Centre is the quickest and most convenient way to activate your Aspire Credit Card. First, on its website, You must declare your authorized name and monthly income to apply for the Aspire Credit Card. Once your card is activated, you can access the Aspire Account Centre anytime. The recommended credit score is 630. Pre-approval from Aspire is essential to apply for this credit card. The pre-approval will not affect your credit score because it only involves a soft examination of your credit records.

In this article, you get to know who accepts the acceptance code in their mail for their Aspire Credit Card. What do next when you receive your Acceptance Code?

Aspire Credit Card acceptance code offers many benefits to their clients. Some of the benefits are:

- credit limit $1,500

- cashback on purchases 2%.

- annual fee $59

Renunciation on the first-year maintenance fee will be $60 from the second year.

But you need to have an Aspire Credit Card to receive these benefits. You need an acceptance code to apply for the Credit Card. You can proceed with your application after you receive the acceptance code in your mail.

Table of Contents

What is my Aspire Digital Credit Card?

On successful registration and credit approval, Aspire provides a digital credit card (an online extension of a physical credit card) that you can requried for online transactions. Your transaction will be initiated as soon as you click ‘Scan and Pay’ and follow the necessary steps, starting with scanning the respective QR code.

How to Activate an Aspire Credit Card?

By phone: the number on the label affixed to the front of the card or Call (855) 802-5572. Authenticate your info (e.g., card number, Social Security number, or phone number associated with your app) to activate your Aspire credit card.

On mobile devices: Log in to the Aspire mobile app (for iOS or Android) consuming the same identifications you would use to log in online. Tap the credit card activation button and enter the security information requested on the next page.

On the website: Login to your Aspire account (or create an account if you don’t have one) and search the start page. Enter the essential security information. Activate your Aspire card according to the instructions.

Your new Aspire card will exist for purchases directly after activation. If you have any problems activating your card, Aspire customer service can always help you. You can call them at (855) 802-5572.

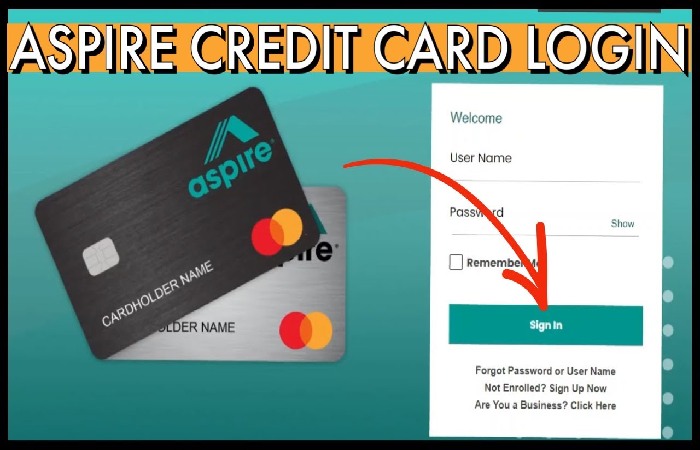

Aspire Credit Card Login

still, you must first register your credit card If you’re a new Aspire credit card stoner. You’ll get your digital credit card once your operation is approved. After entering it, follow this way to Aspire credit card login for net banking.

- Go to the sanctioned website,www.aspirecreditcard.com, and click the signup option.

- Enter the needed details.

- Click the Accept Terms and Conditions check box and also the Submit button.

- You’ll get One Time word on your registered phone number

- Enter the OTP to authorize your number

- Give a solid Leg to register your card.

Upon completing the enrollment procedure, you can log in to the Aspire website with your stoner ID to make deals.

What To Do After You Admit Acceptance Code?

After you admit the Acceptance Code in your correspondence, follow these ways with your operation.

- Go to the functionary point of Aspire Credit Card-www.aspire.com from your web cybersurfer.

- You will see Respond To Offer on the top right of your screen on the website’s homepage.

- Click on it, and a new runner will open. On that, enter your Acceptance Code.

- Also, click on the Submit button.

What Credit Score is required for an Aspire Credit Card?

Dissimilar to other credit card issuers, Aspire approves credit cards to all aspirants irrespective of their credit score. Aspire MasterCard is ideal for druggies with a low or bad credit score.

Still, you’ll be notified of your credit score through dispatch after 60 days of opening your account with Aspire. Your credit limit, yearly, and periodic charges will vary depending on this credit score.

Aspirants taking credit cards for educational purposes can get cards with a credit score handed by Equifax. Aspire offers relaxed credit cards to top-qualified aspirants. You do not need any security deposits to start using this MasterCard. Aspire also does not charge anything against fraud liability.

Aspire Credit Card Reviews

The Aspire FCU Platinum credit card is a balance transfer card that doesn’t offer prices similar to cashback, points, or long hauls.

It provides six billing cycles without interest on purchases and balance transfers(after 9.65 percent to 18.00 percent variable APR). Therefore, it lets you pay off a large purchase or debt in six yearly inaugurations with no fresh interest charges. It isn’t the longest introductory 0 APR on the request, but it can help you significantly reduce your debt.

Conclusion

In this article, we discuss How You Can Essentially Access The “www.aspirecreditcards.com acceptance code.” Use The Features That the www.aspirecreditcards.com acceptance code Offers On Their Portal. to activate your Aspire card. It does not have a specific time limit within which you need it, but it’s best to do it as soon as possible.